17+ Chapter 5 Savings Accounts Worksheet Answers

The Best Chapter Books for Kids Under 10. If the result is zero or less stop here.

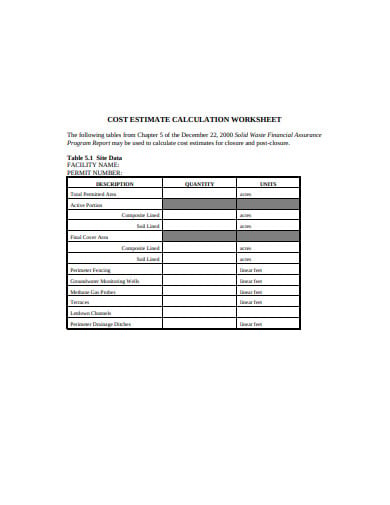

15 Estimate Worksheet Templates Excel Word Numbers Pages Pdf

Education savings bond program.

. Federal government websites often end in gov or mil. HelpWithMyBankgov - Answers and solutions for customers of national banks and federal savings associations. If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021.

Raise Classroom Funds ClassroomsCount Scholastic. Mets really do sign Verlander 2 for 86 3rd year vested OP DanMetroMan 1252022 1225. Modified AGI limit for certain married individuals increased.

Or RRTA tax on tips you reported to your employer or on group-term life insurance and additional taxes on health savings accounts. Dont complete the rest of this worksheet. Informative Speaking Chapter 17.

The unique entity identifier used in SAMgov has changed. Keep for your records 1. See the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount.

Enter fair market value of the donated food _____ 2. The gov means its official. Meg and John complete Worksheets 1-3 1-4 and 1-5.

Everyday Savings Super Savers Books Under 5 Collections Under 25 Save Over 40. Bill in UT 1252022 433 pm. Your Form 1099-INT should show the difference between the amount received and the cost of the bond.

For 2021 the amount of your education savings bond interest exclusion is gradually reduced phased out if your MAGI is between 83200 and 98200 124800 and 154800 if you file a joint return. We welcome your comments about this publication and your suggestions for future editions. You can use Worksheet 1-1 to figure the tax-free and taxable parts.

531 Method of Payment for Compensation Last Modified on January 25 2018 Section 7511 of the BOR Policy Manual states that electronic funds transfer is the required method of payroll payments to employeesAll employees are required to be paid by electronic funds transfer by authorizing the direct deposit of funds into their financial institution account within thirty 30. Enter basis of the donated food _____ 3. Kmed6000 1262022 1126 am.

Installment method used to report original sale. See the instructions for Schedule 2 line 8. Your charitable contribution deduction for food is the amount on line 1.

Enter any amount previously recovered tax free in years after 1986. They can divide the 4459 any way. See chapter 4 of Pub.

NW IR-6526 Washington DC 20224. The following paragraphs explain how to figure your basis in the installment obligation and the character of any gain or loss if you used the installment method to. Best-Selling Books Under 5 for Grades PreK-2.

Persuasive Speaking Chapter 18. They expect to file a joint income tax return. 5 Grammar was appropriate nothing real stood out.

Households or 59 million didnt have a checking or savings account with a bank or credit union in 2021 a record low according to the Federal Deposit Insurance. A SIMPLE 401k plan is a qualified retirement plan and must generally satisfy the rules discussed under Qualification Rules in chapter 4 including the required distribution rules. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAMgov. Get 247 customer support help when you place a homework help service order with us.

116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the. 5 The interface was easily manageable perfect for online learning courses. Roughly 45 of US.

Division O section 111 of PL. In 2022 they will also have 184 in taxable interest and 1000 of other taxable income. 550 for information on nonbusiness bad debts and chapter 10 of Pub.

Multiply line 4 by the number of months for which this years payments were made. Additional Guidance on Military Deposits. OPM developed the Federal Ballpark Estimate a savings goal worksheet.

MLB Network Reporting Cashman Gets 4 year extension. The use of charts graphs photos were complimentary to the particular topic. Line 5 of Worksheet 1-5 shows that they will owe an additional 4459 after subtracting their withholding for the year.

Grades PreK - 2. You had wages of 10828 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes. Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc.

You or your spouse if filing jointly received health savings account Archer MSA or Medicare Advantage MSA distributions. The 121-day period began on May 17 2021 60 days before. Otherwise go to line 6.

Publish print and sell your books globally with our Print-On-Demand network while eliminating the risk and hassle of inventory and fulfillment. Subtract line 2 from line 1. On April 4 2022 the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID generated by SAMgov.

Grades 3 - 12. When you cash a US. You had net earnings from self-employment of at least 400.

After you complete Worksheet 1-2 in chapter 1 of Pub. Before sharing sensitive information make sure youre on a federal government site. However a SIMPLE 401k plan isnt subject to the nondiscrimination and top-heavy rules discussed in chapter 4 if the plan meets the conditions listed below.

Build Your Classroom Library on a Budget. Getting answers to your tax questions. 590-A or the IRA Deduction Worksheet in the form instructions enter your nondeductible contributions to traditional IRAs on line 1 of Form 8606.

535 for information on business bad debts. Rnargi 1252022 311 pm. See separate Worksheet instructions.

Getting answers to your tax questions. Coverdell education savings accounts formerly called education IRAs Pub. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Savings bond that you acquired from a decedent the bank or other payer that redeems it must give you a Form 1099-INT if the interest part of the payment you receive is 10 or more. Anything terrific youve eaten recently. Bill in UT 1272022 456 pm.

If your annuity starting date was before 1987 enter this amount on line 8 below and skip lines 6 7 10 and 11.

Chapter 5 Savings Account Ppt Download

Chapter 5 Savings Quiz Questions Answers For Quizzes And Worksheets Quizizz

Univ148 Answer 3317 We Re Thrilled To Invite You To Start Testing Github Copilot Your Feedback Studocu

Pdf Asset Management Excellence Optimizing Equipment Life Cycle Decisions Denas Piyo Academia Edu

Learners Planet Accueil Facebook

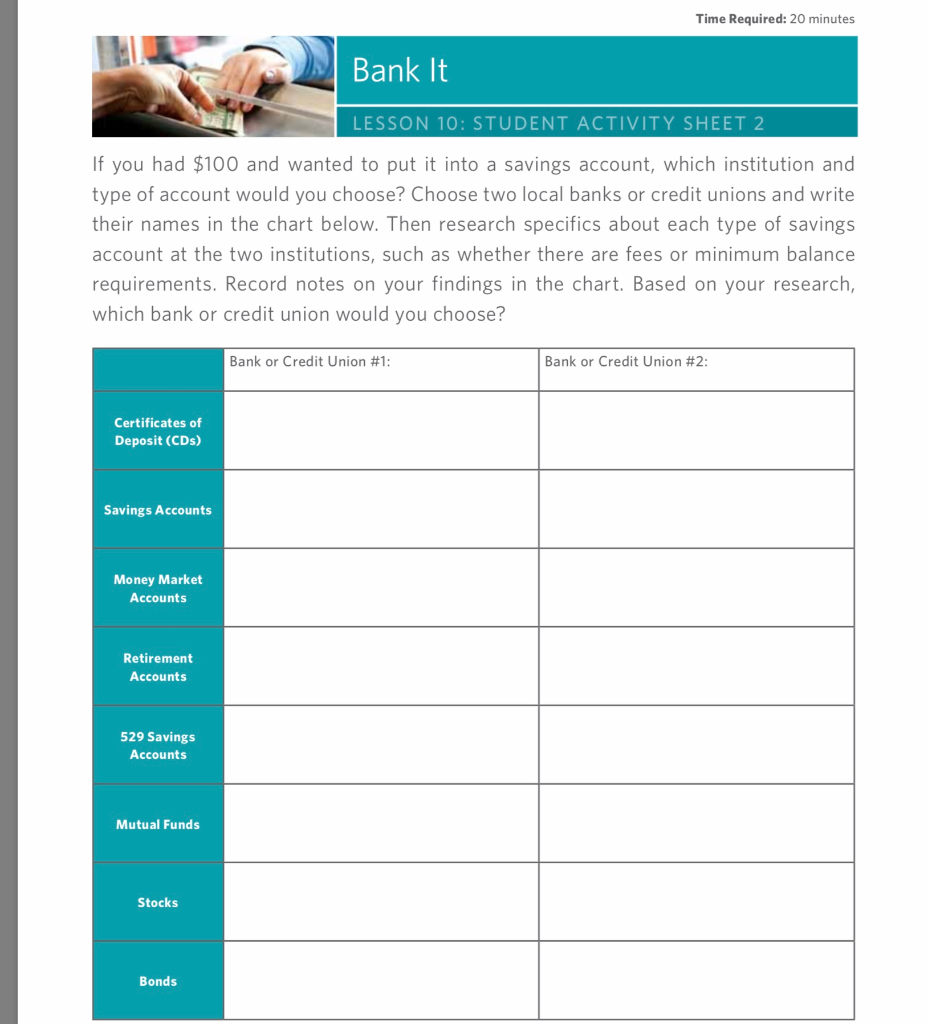

Time Required 20 Minutes Bank It Lesson 10 Student Chegg Com

Federal Register Medicare And Medicaid Programs Cy 2016 Home Health Prospective Payment System Rate Update Home Health Value Based Purchasing Model And Home Health Quality Reporting Requirements

Platinum Mathematics Grade 5 Lesson Plans Pdf Multiplication Fraction Mathematics

Lesson 5 4 Prt Formula

Chapter 5 Savings Account Ppt Download

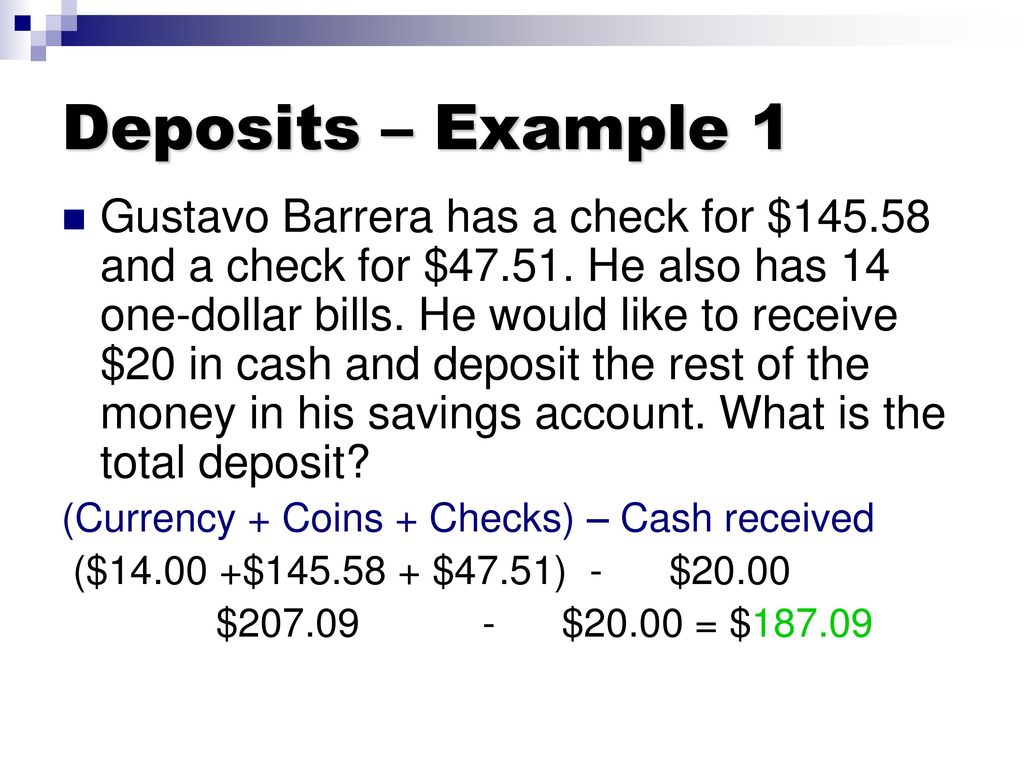

Chapter 5 Savings Accounts 5 1 Deposits Savings Accounts Earn Interest On The Money In The Account For Banks Use Of Your Money Deposit Money Given Course Hero

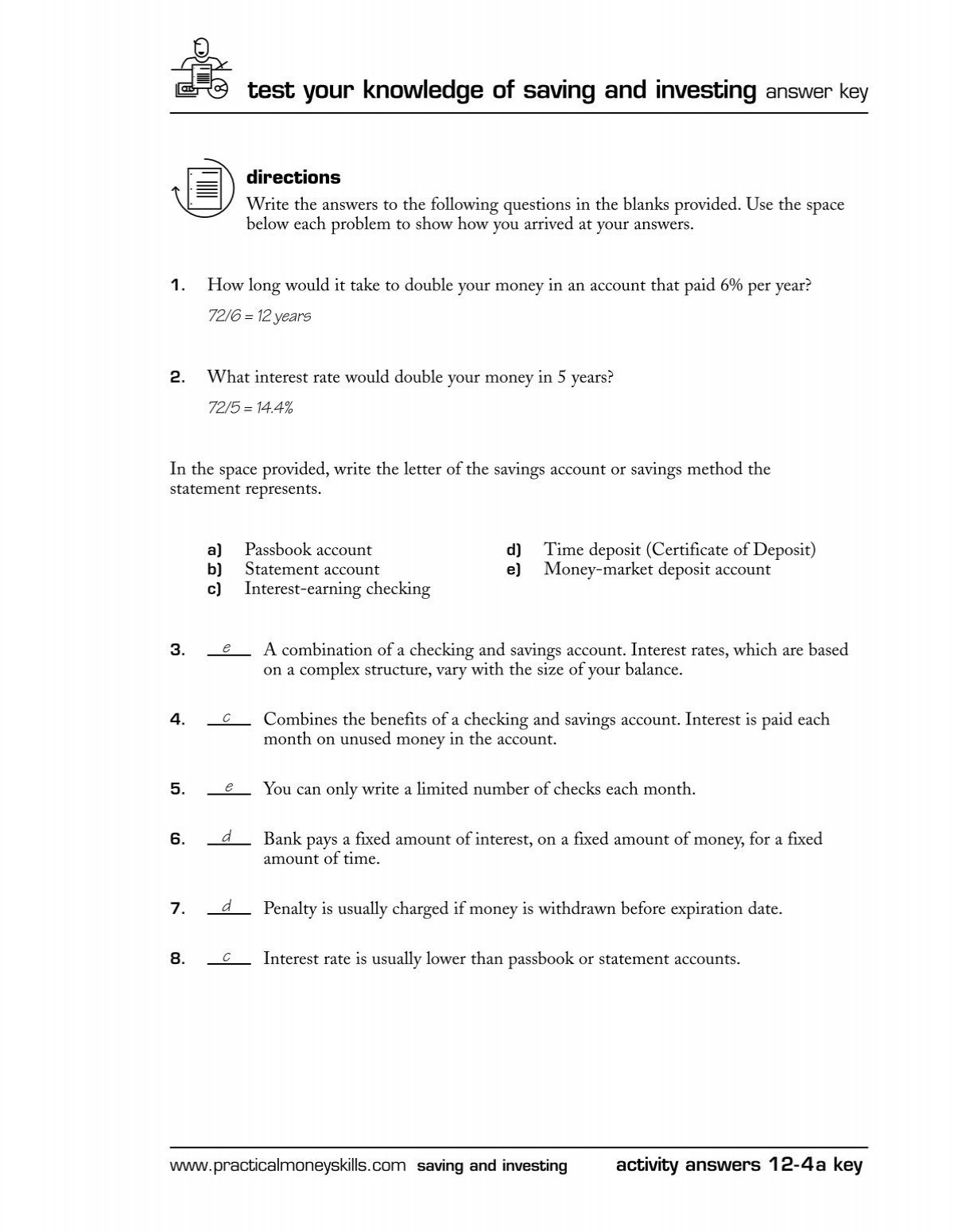

Test Your Knowledge Of Saving And Investing Answer Key

The Other Side Blog Review Class Struggles Bx Options Class Builder

Chf Transitioning Guide

Macmillan Readers 2012 Catalogue By Macmillan Education Issuu

Chapter 1

Chapter 5 Savings Accounts By Lawrence Smith